How Covid-19 is Impacting eCommerce & 6 Strategies to Maximize Success

COVID-19 has greatly impacted brands and retailers as brick-and-mortar has come to a halt in most industries due to lockdowns and social distancing. While many consumers are turning to eCommerce as a trusted alternative, they are also becoming increasingly cautious about spending money on non-essentials. Although consumer spending is down in the majority of industries—and is expected to remain that way for an undetermined amount of time—online channels are seeing less of a decline than their offline counterparts, with some industries even on the rise.

Source: McKinsey & Company

For many companies, especially omni-channel retailers, eCommerce is the only thing keeping them afloat, as they are seeing increased volume in online purchases. While others, particularly pure-play eCommerce brands in the non-essentials category, have seen significant drops in online revenue due to reluctant purchasers, and increased competition from new entrants to the market. Finally, for those who have been late to the digital transformation game, this is new territory altogether, and time is of the essence to deploy a digital solution.

Source: Within

As online browsing surges, and major players like Amazon pull back on their digital spending due to an influx of demand for essentials, the cost to acquire traffic has dropped by as much as 50% in some sectors. However, due to a dip in consumer confidence caused by uncertainty of future finances, consumers have also become less likely to purchase, resulting in significantly lower conversion rates.

Source: WordStream

Source: Global Metrics on Facebook & Instagram

As companies ride this rollercoaster of information, they are looking for guidance on what to do next in order to mitigate the effects of these adverse consumer market trends. That is why we put together this resource, as a means to provide information, guidance and strategic inspiration to eCommerce retailers who wish to be proactive and maximize their chances of success in these uncertain times.

6 Strategies for eCommerce Retailers to Maximize Success Amid the Covid-19 Pandemic

1. Adjust Branding & Creative Messaging

One of the first areas that companies should be looking at is their creative and brand messaging. In a critical time like this, when the entire world is feeling the pressures of this pandemic, the last thing you want your brand to be seen as is insensitive or worse, opportunistic. As a starting point, review your website content, ad creative, and social media posts to ensure there are no images or copy that could be seen as inconsiderate. For example, now is not the time to be posting photos of recreational travelling or large groups of people.

As a step further, brands should be altering their creative to adapt to the current times. Whether that be offering statements of support, messages of hope & solidarity, encouraging people to participate and take action, or simply by providing utility and value in a time of social distancing. Although not all brands are able to adapt their businesses the way Canada Goose or GM have, they can still adjust their creative to better speak to the realities of their customer’s situations.

2. Find Hidden Opportunities

For select industries such as food & beverage, at home entertainment, and home fitness, there are significant increases in online consumer spending—but for many industries, this simply isn’t the case. However, that doesn’t mean that opportunities do not exist at all.

Source: McKinsey & Company

With more granular research through tools like Google Trends, retailers may be able to find opportunities where specific products and categories are actually in higher demand. For example, although the apparel industry is experiencing major setbacks, mostly due to the closure of brick-and-mortar retail, searches for loungewear are at an all time high with an increase of more than 300% YoY. This is largely due to the nature of people spending the majority of time at home and wanting to be comfortable. For a list of the top 100 fastest and growing & declining categories in eCommerce see this great list by Stackline.

Source: Google Trends

3. Highlight What Matters Most

By creating tailored landing pages and promotions which highlight products that are more likely to be valued during this period, retailers can increase the likelihood of traffic converting into purchases. Showcasing these products on the homepage, promoting them through email marketing campaigns, and featuring them in ad creatives are immediate tactics that can be used to further support this.

In addition to curating product offerings, it is important to highlight key value propositions that address the concerns of online shoppers. The following is a list of opportunities that most e-commerce retailers can implement immediately to help reduce barriers to purchase:

- Offer and promote free shipping

- Address shipping concerns and delays with accessible FAQs

- Highlight and expand return & exchange policies

- Offer buy-now-pay-later solutions (eg. Afterpay, Affirm, Sezzle, Klarna, etc.)

- Use live-chat and display phone numbers to provide additional customer support

- Promote pre-orders for upcoming product

- Suggest alternative products for popular products with low inventory

- Enhance product page data such as images, videos, and descriptions

- Highlight price match guarantees

- Create bundled products to increase average order values

- Merchandise category pages to highlight top sellers and sale items

Last, and furthest from least, the highest impact tactic you can use to increase conversion rate is to offer a discount or sale. As many brands and retailers are left with excess inventory and conversion rates continue to decline, discounting has become one of the only ways to compete. Of over 400+ of the top DTC brands listed in 2PM, Inc.’s DNVB Power List, over 34% of them were found to be discounting. Even discount-averse luxury brands are starting to give in as they see sales decline.

4. Stay Engaged With High Value Customers

For many brands, it is not uncommon for a small subset of customers to be responsible for the majority of their online revenue. That is why it is important to stay engaged with your existing customers and nurture your brand loyalists. Consider creating personalized offers for high LTV customers such as VIP discounts or early access to product launches in order to break through the noise of competitors. Maintaining a consistent email marketing strategy, increasing investments in retargeting, and engaging customers through social media will be crucial for retaining these high value customers.

5. Capture & Nurture The Top Of Funnel

With traffic acquisition costs being low and conversion rates suffering from “window shoppers”, it is important to capture emails as early as possible in order to maximize the value per visitor. Leveraging pop-ups and email capture forms in conjunction with offers such as discount codes or free downloadables is a great way to fill the top of the email funnel. However, in order to get the most from this traffic, it is important to set up automation such as a welcome series, which on average has an open rate 63% higher than a traditional email campaign and an 86% higher click rate.

Source: Klaviyo

6. Leverage Your Data For Granular Insights

For retailers experiencing a decline in conversion rates, they must analyze their data in shorter time periods and more granular stages in order to gain a clear picture of what is causing the shifts, and at which stage of the funnel the drop-off is happening. Look at week-over-week performance from the point at which you see a decline in sales and analyze each step of the funnel to determine where your attention needs to be spent. For many the “cost per add to cart” is where you will see a large drop in performance due to many site visitors “window shopping”.

Compare the variance in the following stages of the purchase funnel:

- Cost per product view initiated

- Cost per add to cart initiated

- Cost per checkout initiated

- Cost per checkout completed

Plan for the Comeback

Aside from the immediate actions to minimize the downside and maximize short-term opportunities, it is important to remember that at some point markets will recover, and preparation for that should start now.

Source: Bain & Company

Source: McKinsey & Company

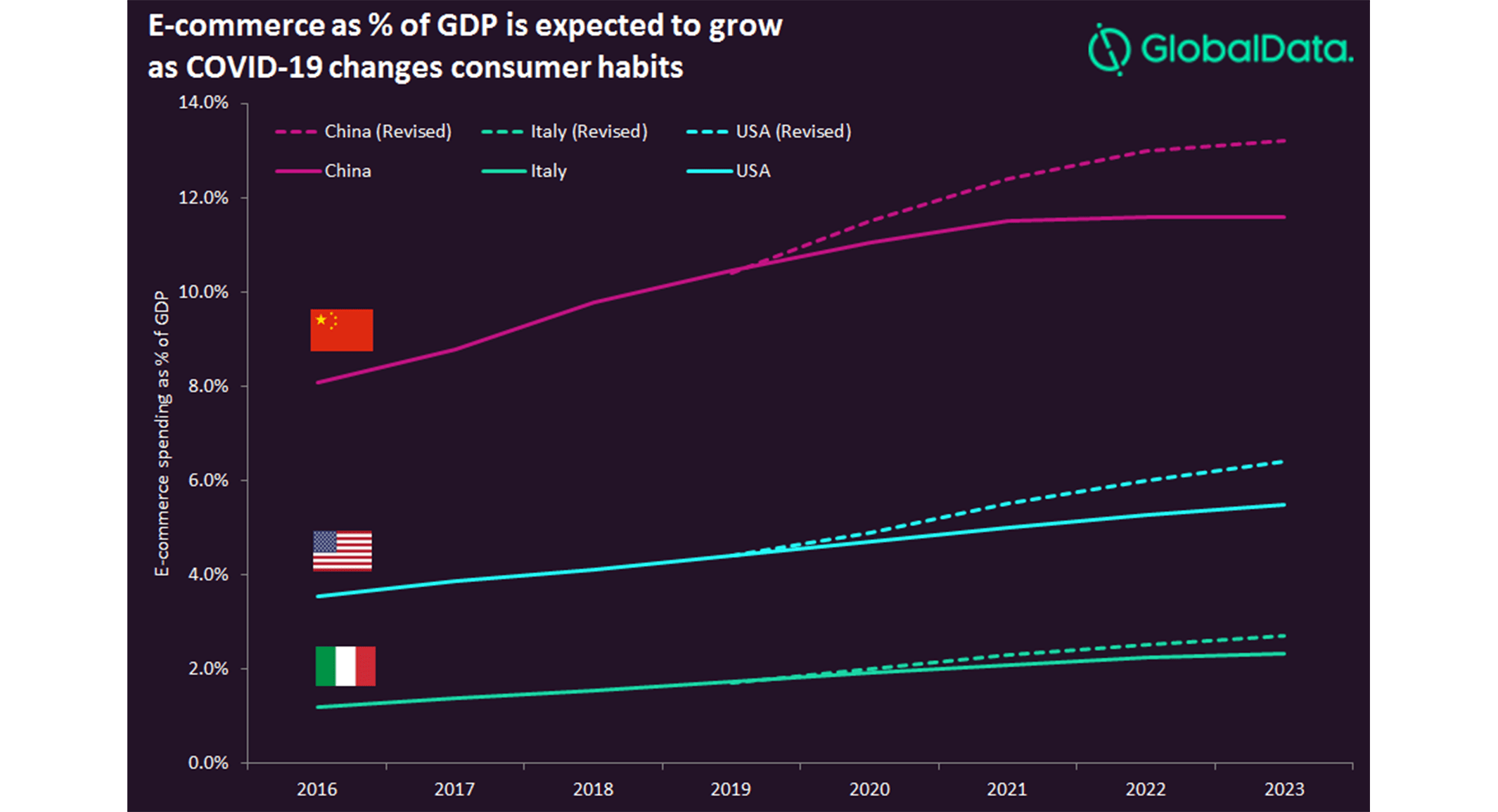

As consumers have made significant shifts in their purchasing behaviour by embracing online retail, this will likely serve as a catalyst for businesses to pursue a digital transformation. As eCommerce becomes the new norm, and retailers invest heavily into omnichannel, the online markets will soon increase in competition, making first-mover advantage ever more important. Now is the opportunity to begin revising channel-mix investments, by allocating a greater share to online mediums. While investing in personalization and digital marketing will only help to bridge the quality gap between offline and online experiences.

There is no doubt that this pandemic will make for a difficult year ahead for many retailers. However, it also presents an opportunity. By taking immediate action to minimize the impact and being proactive in planning for the future, companies can position themselves to emerge from this even stronger.

Source: GlobalData

Stay informed, sign up for our newsletter.